Hot Market Report

Hot Market Report

Hello

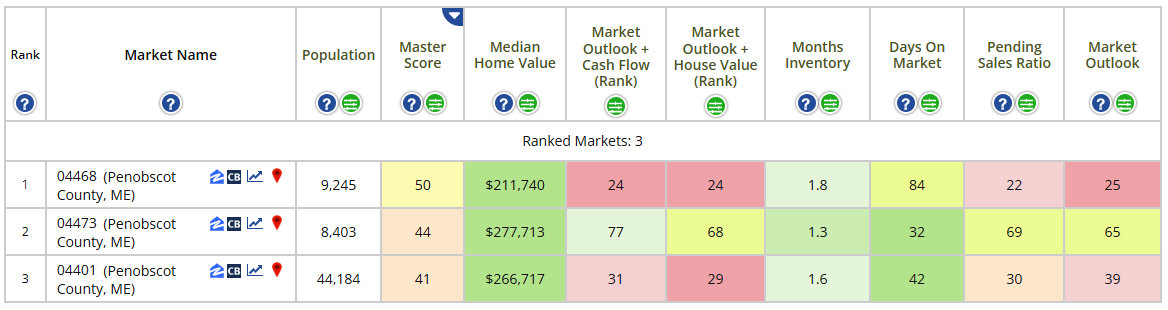

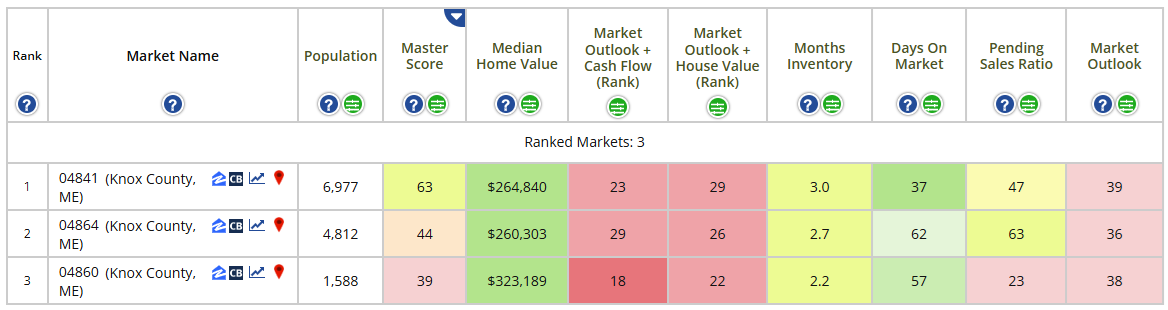

I use a proprietary software called Precision Market Finder, powered by HousingAlerts.com to help pinpoint what markets are booming and which markets are failing. Not to say that you cannot be successful in any market, because let’s face it, houses do sell in every market, but wouldn’t it be nice to know which markets are doing better than others. Whether you are looking to wholesale, fix-n-flip, or buy-n-hold, this software can pinpoint the best markets down to the zip code.

To have firsthand access to this software would cost up to $1164 a year, however, I am offering a special introductory price of just $19.99 per report.

REPORTS OFFERED (by Zip Code)

Wholesale – Flip

1. Nationwide (W1)

2. Statewide (W2)

3. Metro Area (W3)

4. County (W4)

Buy-N-Hold

1. Nationwide (B1)

2. Statewide (B2)

3. Metro Area (B3)

4. County (B4)

*Nationwide report generates top 100 markets. The other reports varies based on the geographic region.

THINGS TO CONSIDER

Most people think that finding motivated sellers, bringing in cash buyers, and the art of negotiation are the most important parts of this business.

However, none of that matters unless you're in the right market.

You could do everything right, but being in the wrong market, could mean being stuck with a house that won’t sell or rent, resulting in a BAD DEAL.

BUT, if you're in the right market, your odds of closing deals faster is that much greater.

So, how do you find the right 'WINNING' market? You order a report from Cardinal Homes Design Group, at a fraction of the price, tailored to the market you are interested in investing.

How To Find WINNING Markets When Over 50% Of Markets Are FAILING: Over 50% of ALL US Metro Housing Markets are FAILING. Overpriced. Nothing is selling. Thousands of houses for sale in a single market... Going into one of these failing markets, thinking you're going to be a successful investor will ruin you. Instead, you will see which markets are booming.

Markets change all the time. They go up and down depending on many different variables. The data for these reports are updated regularly and can result in different results monthly, making it a good practice to periodically check in on your markets.

KEY TO THE TERMINOLOGY YOU WILL FIND IN THE REPORTS

Ranking Color Key

In addition to the actual scores, values, or percentages shown in the table below, we also COLOR CODE most cells.

This will show where each indicator ranks when compared to ALL similar markets we track, NATIONWIDE.

The COLOR CODE corresponds to each indicator's "Score Scale".

Green Colors

... used for the strongest/top percentiles.

Yellow Colors

... used for the middle ranges.

Red Colors

... used for the weakest or least desirable for that indicator.

You can use these Ranking Colors to quickly evaluate how any market 'stacks up' against all similar markets nationwide!

Rank

All micro markets you subscribe to are ranked (using our proprietary scoring systems) based on the 'active' column on the right (indicated by the small triangle).

Clicking any blue column TITLE will make THAT column 'active' and re-rank the results. Clicking the same column again will reverse the ranking order.

IMPORTANT: Ranking results are limited to ONLY THOSE MARKETS IN YOUR CURRENT SUBSCRIPTION and therefore may exclude stronger or weaker micro markets you are NOT subscribed to.

Market Name

Population

Estimated total population for the micro market.

Note: Small population micro markets have fewer real estate transactions and other data points. The resulting smaller sample size generally reduces the reliability/accuracy of the results, often referred to as "statistical noise." Be careful when analyzing small micro markets as the indicators usually have far more 'variation' and noise in the results.

Master Score

The "Master Score" is a proprietary algorithm combining the TAPS, STAR and other indicators into a single score. This is the best single indicator (if you only want to look at ONE scoring element).

Past performance of any indicator, score or algorithm is not indicative of future results. Do your own analysis before entering or exiting any market.

Median Home Value

This is the estimated median house value of all Single Family Residential (SFR) properties in that market.

Gross Rent Ratio

This is the ANNUAL gross median rent (monthly x 12) divided by the median property value. A higher ratio is likely to generate more cash flow then a lower ratio.

Note: Many factors other than gross median rent affect cash flow, including vacancy, repairs, operating expenses and management. The actual ratios can and likely will vary significantly from those shown here. Since the same methodology was used for all similar markets nationwide, we're able to focus on the RELATIVE scores/rankings between different micro markets.

These calculations are for educational and comparison purposes only and do not replace your own Due Diligence!

Click on the blue column title to rank the list by this indicator; click again and it will reverse the order.

Median Rent (3-Yr CAGR)

This is the ANNUAL percent change in median rent for the median house over the last 3 years. (CAGR (Compound Annual Growth Rate) is a more accurate measure of annual % change over a multi-year time period.)

Months Inventory

Active Listings for current month divided by Sold + Expired listings from prior month.

Days On Market

The median number of days between a property's listing and when it is noted as 'sold' or 'off the market'.

Pending Sales Ratio

Pending sales as a percentage of all Active listings.

Market Outlook

The anticipated future health and vitality score for each individual State, Metro, County and Zip Code market based on recent (shorter-term) transactions.

Generally, scores below 30 anticipate new or continued weakness. Scores between 30 - 70, if stable over the last several years, anticipate a continuation of current market conditions. If the score is TRENDING up withing this 30 – 70 range, it may indicate an improving market; if trending down, a weakening market. A score above 70 anticipates a strong or strengthening market.

Past performance of any indicator, score or algorithm is not indicative of future results. Do your own analysis before entering or exiting any market.

Disclaimer

The information contained in this report is for general information purposes only. The information is provided by Cardinal Homes Design Group thru Precision Market Finder powered by HousingAlerts.com and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the report or the information, products, services, or related graphics contained on the report for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this report.

When you submit your order, you will receive an email with a link to download “Picking Your Market” which explains the report. Once I receive the order, I will generate the market report to your specific request and email it to you.